Deosai Ventures launches public document for startup funding.

FT. Market pulse with Deosai Ventures

ATTN: Pakistani startups

I’d like to amplify your message if you’re raising funds.@DeosaiVC shares lots of private deals with investors in our network but we want to create a public doc to speed up the discovery process in this slow market.

*Not a paid matchmaking service. pic.twitter.com/G7Je2pIuzU

— Shehryar Hydri (@sheryhydri) August 23, 2022

The first batch of startups is live now. The current list showcases 60 upcoming startups from a variety of industries. View the current list here. Founder Pakistan interviewed the Managing Partner of the VC Fund, Shehryar Hydri the questions and answers are listed below:

What is the investment thesis of Deosai Ventures?

We’re sector agnostic so we’ve cast a wide net in terms of verticals:

5. Inventhub – SaaS platform for hardware design. (The GITHUB of hardware).

6. Scribe Audio –

What is the investment philosophy to back startups in a downturn?

Deosai has doubled down on its existing portfolio during the downturn to make sure that they have the support they need. Deal flow will be slower over the next 12-18 months as all the funds will consolidate and then start deploying more next year once the market stabilizes.

That said, there will always be great startups raising at rational valuations in 2022-23 and those will definitely get everyone’s interest.

What are the future milestones that you see happening in the ecosystem?

So far, the fundraising numbers for 2022 were not as bad as expected despite the slowdown. We’ll see a lot smaller deals at more realistic valuations as compared to the $30-50 million mega-rounds of last year. Those will be few and far between and it’ll be healthier for our ecosystem for those funds to be divided among more startups.

After this new normal in terms of smaller rounds and valuations, we’ll see companies focused on sustainable business models and unit economics rise up as the most investable startups over the next 1-2 years. The smart teams will focus on building their product and cementing their product market fit during this downturn and they will find it much easier to raise larger rounds for their growth in 2023-24.

We will also see a lot more angel syndicates and family offices investing in a more structured way, taking advantage of this vacuum left by the retreating foreign funds. This is a great by-product of the current market conditions as this will fill a much-needed gap in early-stage investing in Pakistan.

We’ve seen a wave of interest in qCommerce, eCommerce, mobility, and fintech and are now seeing secondary level investments in the same verticals as well e.g. mobility startups in carpooling and EVs have renewed interest now due to the soaring fuel prices. The ignored sectors which were hard to crack so far were Edtech and health tech, but they are also seeing more activity now.

Everyone wants to be the Byju’s of Pakistan but that’s easier said than done. Healthtech will now see some prominent regional players getting interested in our platforms. Agritech is a strategic sector in terms of food security and we’re seeing a lot of interest building up there as well. Other overlooked verticals include media and local content, as well as some of the new waves of web3, AR/VR, and crypto.

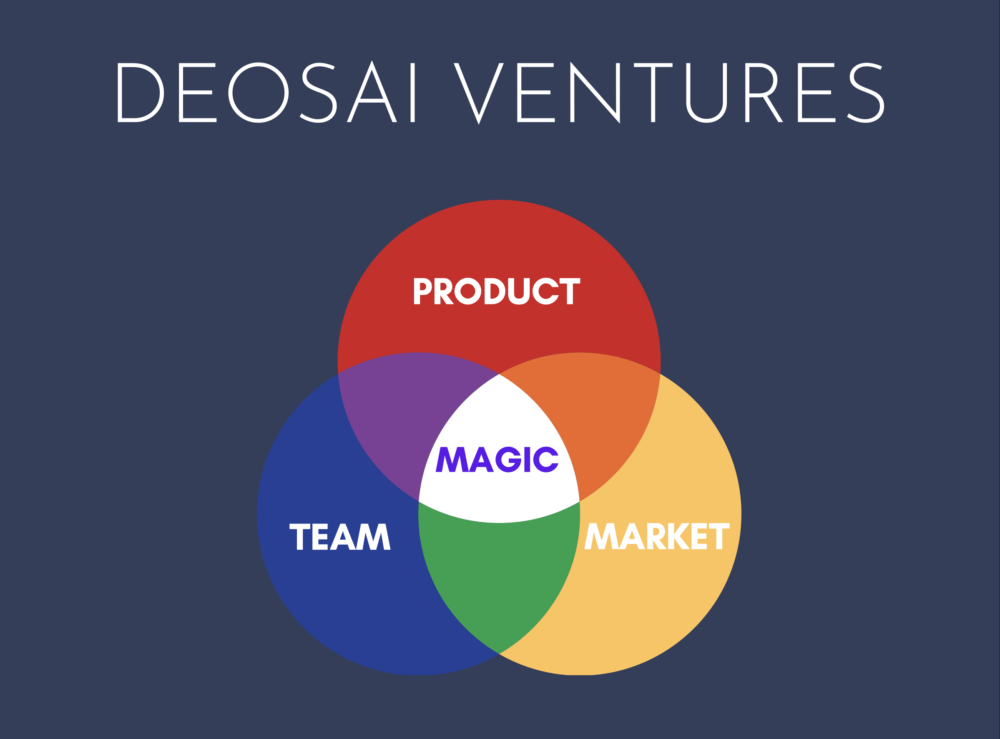

We use a simple framework for our investment decisions and that looks at the following factors:

Advice for founders who are looking to raise?

This is the toughest time to raise but round sizes in Pakistan can easily be constructed as a mix of angels and small VCs. Founders cannot be picky right now, so they need to be more flexible in terms of who they raise from and the terms on which they close a round.

You may not have planned on having 20 angels on your cap table without a well-known VC lead but if that’s what it takes to get you to the next milestone and raise a larger round down the round, that’s what you need to do to survive and grow. Generally, suppose you have a solid business model and revenue that can be scaled. In that case, you’re already in a thin minority that will be more noticeable and investable than the flock of “growth at all costs” startups we saw over the last 2 years.

Founders also need to look at multiple revenue sources that may not match their long-term strategy but will be invaluable in getting them through this tough market. Long-term survival is the name of the game right now.

Are you satisfied with the quality of startup ideas and teams in the ecosystem?

The quality of teams and startups has improved tremendously over the last three years and one of the reasons is that we’re seeing more mature mid-career founders who are leaving their corporate jobs or previous career trajectories and taking a stab at building solid startups.

They are not experimenting in this new “startup game” but have deep domain knowledge and are trying to solve genuine problems, as compared to some of the other younger founders who were just making products for issues that did not exist.