According to PARCA, the Gross Loan Portfolio (GLP) reached PKR356 billion in June’21, with a higher tilt by 10% from PKR324 billion at the end of December’20. An almost identical increase of 5% was reported in the first and second quarters of CY21. Active borrowers climbed by 15% to 8 million in June’21, from 7 million at the end of December’20.

According to PARCA, the Gross Loan Portfolio (GLP) reached PKR356 billion in June’21, with a higher tilt by 10% from PKR324 billion at the end of December’20. An almost identical increase of 5% was reported in the first and second quarters of CY21. Active borrowers climbed by 15% to 8 million in June’21, from 7 million at the end of December’20.

The loan sector has had a difficult year in the fiscal year 2020. A key danger that emerged with the COVID-19 pandemic was the potential of non-recovery from clients who were in serious debt owing to lockout and extraordinary circumstances.

The credit market has been badly impacted by 2020 macro developments. According to the Global Lending Market Report 2020–2030, the 2020 annual growth rate (CAGR) indication fell to -1.9 percent, as prevalent types fell from 6,875.5 billion USD in 2019 to 6,751.3 billion USD at the conclusion of 2020.

At the same time, all lenders are being obliged to lower lending rates. More than half of the loans are being provided at a rate that is at least 95–98 percent lower than in prior years. Despite a slowdown in activity in H1 2020, the market is rebounding, and leveraged loan issuance is expanding beginning in July 2020.

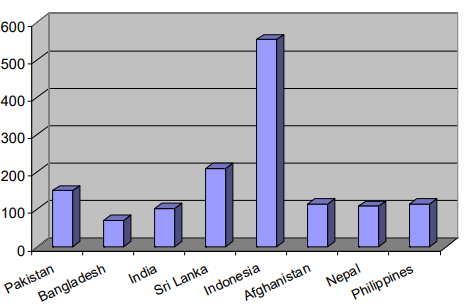

The average loan per borrower is a commonly acknowledged metric for determining whether the sector is targeting low-income borrowers. According to the PSIA report, Pakistan (US$151) has a lower average than Indonesia ($554) or Sri Lanka ($209), but a higher average than the others (which vary from $72 to $116), reflecting a lesser degree of access for poor borrowers.

Controlled variables and balance sheets

If a loan shark is an unlicensed moneylender who often targets families on low incomes or those who find themselves in difficult times and a payday loan provider offers short-term borrowing where a lender will extend high interest credit based on your income, then the best of both worlds have sprung up in Pakistan in the form of digital loan shark apps.

An advertisement for Barwaqt, for instance, suggests that a loan of Rs. 50,000 would be charged at a 1% interest rate. However, user reviews on the Google Play Store suggest interest rates that are much higher against payback periods that are shorter than that expected by the user.

This could be a gap between the user interface during customer attraction and post-purchase communications. This could also be a matter of financial literacy. All in all, the reviews for these apps – when sorted from one-star to three-star – suggest predatory behaviors often associated with loan sharks and payday loan providers.

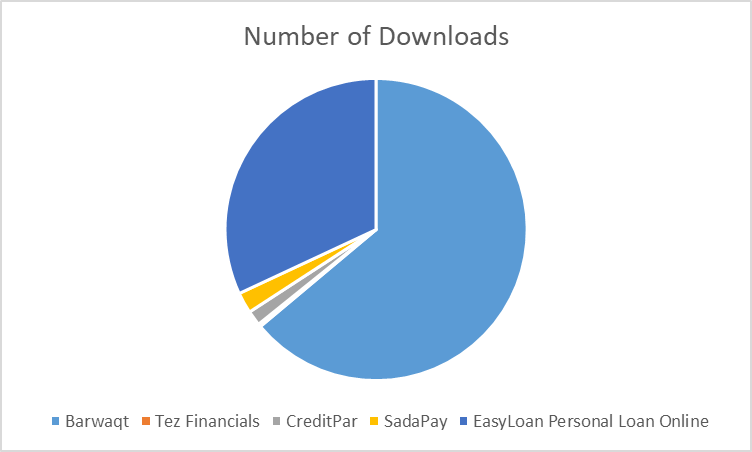

It is worth noting that it is entirely likely that the Barwaqt app – which data from Sensor Tower suggests has nearly two million downloads – is very transparent in its interest rates communications. It is likely that financially illiterate users are unable to understand the financial communications or copy being presented to them. It is also worth noting that in a market without a credit score, a high interest to offset the risk of risky borrowers makes perfect business sense.

Short-term borrowing apps can increase income through controlled loan expansion if their balance sheets are stable and healthy. However, a concentration on greater yields or profitability renders borrowing cheaper to get for individuals and firms, which often leads to additional nonaccrual loans and a drop in bank capital. As a corollary, the growth of bad loans lowers an app’s insolvency.

Excessive credit inflow can wreak havoc on a lender’s balance sheet. In light of this, higher loan growth can invariably translate into higher loan losses when major macroeconomic parameters such as GDP growth, inflation, and unemployment are taken into account.

Fintechs’ participation, albeit in conjunction with banks, might be viewed as a positive indicator. Local startups, for their part, did show an interest in the credit market. The most prominent of them is Finja. It has been among the first few tech-enabled financing for both B2B and B2C. Tez Financials, Creditpar, Trellis, Barwaqt, and many other tech-enabled digital financing apps are working in the market.

User Experience with loan apps

Financing loan(s) apps saw a hit in terms of acceptability by end-users. It is evident by the fact that one of the apps; Barwaqt, has been downloaded by eight million people. But in terms of user experience and go-to app; EasyLoan Personal Loan Online, JazzCash, EasyPaisa, Barwaqt, and Zindagi have ranked in the top five positions. Bada Loan – Cash Loan Instant is trending up in the loan financing domain.

Though the loan apps saw a hit, there’s another side of the coin as well. Reviews suggest higher interest rates for shorter payback periods. Reviews imply that the interest rates communicated prior to accepting terms were different from those insisted on after getting the loan in hand/account.

One of the reviewers while talking about Barwaqt said, “I will not recommend anyone to use this loan app. You have to pay higher interest rates even if you have borrowed a minimum amount.”

Another previous user of Barwaqt said, “Firstly they falsely advertise their service and secondly if somehow you manage to use it, they will reduce your account limits or may block your account for no proper reason.”

Another user of Creditpar reviewed the services and said, “The biggest problem is that they charge very high interest on it and nothing is explained in detail in the application, and those who receive their SMS, discounts, etc. are not implemented, i.e. no discount was received.”

To fix this, SBP entered an understanding with the SME Asaan Finance (SAAF) Scheme by inviting the interest of banks through Expression of interest (EOI) that desire to build their SME loan portfolio.

Time-bound refinancing for three years would be provided by the central bank to the banks selected through a transparent bidding process. Banks will reimburse the refinanced money in 10 equal annual payments after three years.

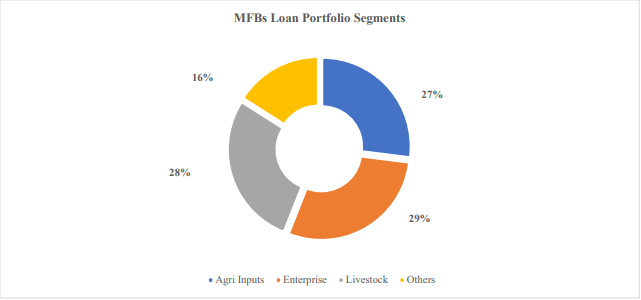

According to statistics from five MFBs; NRSP, APNA, Telenor, FINCA, and Advans, the sector’s credit portfolio is very diverse in Agriculture, Livestock, Enterprise, and others, with each segment possessing just over a 30% prevalence in the MFBs’ credit balance.

Banks and the Fintech players

A solitary banking institution cannot create financial infrastructure for all of its clientele, banks collaborate with payment solution providers to improve their operations and attract all of their customers.

These are some of many tech-enabled, regulated and non-regulated loan shark apps working in the space but the issue of connectivity stands where it is. It can be solved by a simple few steps if regulators and decision-makers are willing to take them.

With the API gateway, the process of integrating with Pakistan’s digital payments platform can become simple, cost-effective, and time-saving. Raast isn’t a bank or a mobile wallet; rather, it’s a backend payment system akin to 1link that aims to bring all of the country’s banks on board to provide the public with the best digital payment experience possible.

“Open API will work out for a framework of integrating digital payments,” said Ammar Habib Khan, Chief Risk Officer at Karandaaz. “It will happen soon as all integrations with Raast will be through Open API.”

Different tiers of financing: Opportunity up for grasp

This framework in the space of intra-bank-fin-tech companies for loans can be a success with other models of person-to-person transfer and the use of Raast by the merchant. All of these elements hint to the fact that new competitors are increasingly focusing on the gap that established financial institutions have typically left behind.

The issue with them, however, is the high rates which may often reach 30 percent which no amount of ostensibly rational reasoning can alleviate. Thanks to the SBP’s low-cost refinancing, SAAF and Raast have the capability to remedy this issue.

Icing to the cake is the second and third-tier schemes of Kamyad Jawaan and Kissan Programmes targeting the domains of startups and SMEs with a financing range of between one to ten million and ten to twenty-five million.

“Fintechs can integrate their preexisting SME clientele with a past history and use them as recourse to conventional financing from conventional banking,” said one of the board members at Advanc Pakistan. “Fintechs don’t have the competence to credit up to Rs 10 million, but they do have statistics on SMEs, while banks have the ready cash but no information on SMEs or a mechanism to identify them in an outlay approach.”

Raast and SAAF are significant steps forward for Pakistan since they will speed up digital financial transactions. It will also guide the country’s embrace of digital payments. In Pakistan’s digital payment ecosystem, with realistic targeted micro-macro digital financing models like the Kissan program and Kamyad Jawaan, gateway connectivity and integrations will improve service delivery. Here’s to cautious optimism.

–

Despite contacting the senior management of Tez Financials, Creditpar, Trellis, and Barwaqt for a comment regarding this story, they declined to respond within the 24-hour deadline.

Update: The SECP had removed all the loan apps from the play store, however, these apps have resurfaced again- and existing players have also started other apps under different brands to protect themselves. Various sources tell Founder Pakistan that the loans now have a license to continue their activities.

Officials at SECP were not available to comment when approached by Founder Pakistan.